Faq

Tax planning is a proactive process that happens throughout the year. It is the process of looking at your personal life, your business, your financial goals and 70,000 pages of tax code to legally reduce your taxes.

Tax preparation happens at the end of every year and is the process of preparing tax returns for submission to the IRS. Once the year is over it limits the amount of strategies that we can use to actually save you money on taxes for that year.

We cover 90 plus strategies in the following categories:

a. Maximizing all deductions

b. Legal Entity Optimization

c. Entity bifurcation

d. Revenue Stream Separation

e. Retirement

f. Insurance

g. Asset Protection

h. Legal Tax Loopholes

i. The Tax Cut & Job Act

j. The CAREs Act and COVID-19 Strategies

k. Industry Specific Strategies

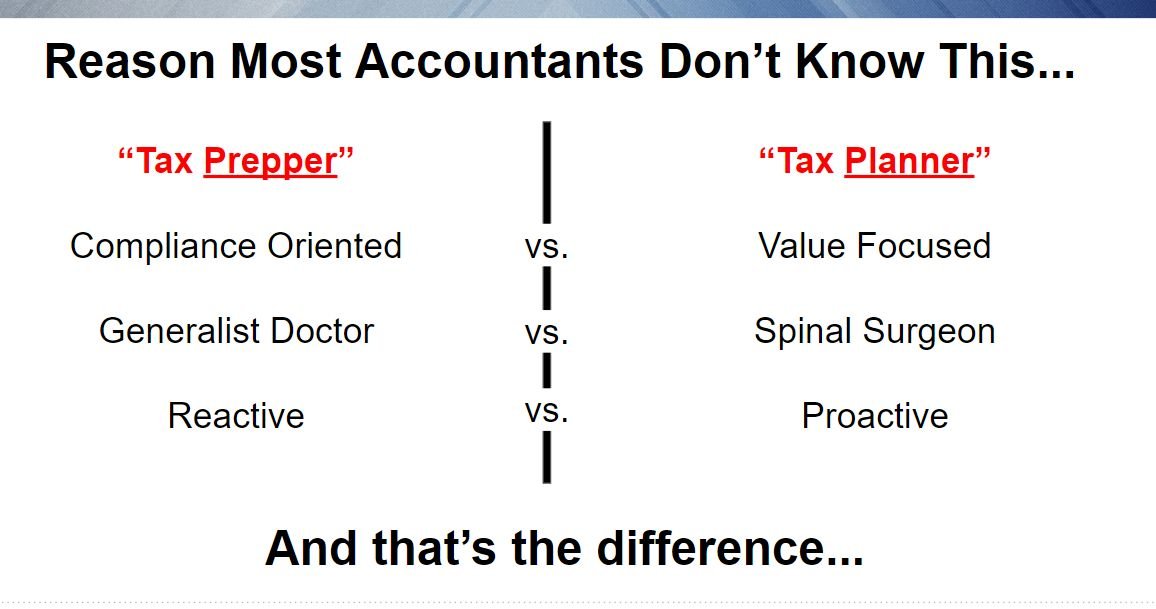

We look at how we can reduce your tax burden, meaning that you pay less taxes. That is more money for yourself or to grow your business. A general accountant only makes sure you are compliant with the tax deadlines and doesn’t look for tax reductions.

Most accountants are focused on preparing tax returns for compliance purposes and they are not really taking a step back and saying “how should we be saving your business money each year?”

We don’t offer guarantees because honestly, it gives people an option to fail and back out. The reality is that we both have to work at this to make this successful.

We are going to need information from you, decisions, and it’s going to take both of us to make this work.

We’ll be working together every step of the way and I can say with confidence, we’ll definitely be able to save you the money that we quote in our tax consultation.

I can promise you that if you show up and get me everything we need, we will be there to support you 100%!

We do not charge by the hour. We offer transparent pricing so you always know what you are going to pay before you decide to work with us.

Yes, the investment to work with us is 100% tax-deductible through your business. Before people begin working with us they are overpaying their taxes to the IRS and unfortunately, taxes paid to the IRS are not a deductible expense. So you have 2 options:

1. Keep overpaying your taxes each year, which is not a deductible expense.

Or

2. Work with a Tax Planning Pro, write off this investment, and save 20-50% on your taxes each and every year.

Unlike the traditional CPA that you see once a year, with Raruzen Accounting you’ll get four meetings per year with our founder and CEO. Additionally, you can reach out anytime with questions, concerns, or updates. Learn about some of our services here.

This is one of the biggest misconceptions about our business. What you need most from your accountant is someone who understands your industry to make proactive strategic recommendations, communicates with you all year, and works to reduce your tax burden.

Generally, you will first want to obtain some documents from the current accountant, including copies of tax returns and access to your accounting system if you don’t have it already. Raruzen Accounting will help you ease through the transition and ensure you know exactly what to ask for.

You can book a free assessment by booking a meeting. See links below.

PPP Loan Funds should be used for payroll, business mortgage interest, business rent, and business utilities. Economic Injury Disaster Loan proceeds can be used to pay for our services as an ordinary and necessary tax-deductible business expense.

WHAT OUR CLIENTS SAY

Rachel is one of my favorite persons to work with. She leads her team by understanding the motivations of her team members that work directly under her supervision. To me, she’s very intelligent and has many polished attributes that make her a unique and great leader. I consider myself a lucky person to have the chance to gain a lot of valuable knowledge and skills from her directly. I believe that she will be a great addition to any organization that partners with her and her firm for any accounting and tax needs!

LOC NGUYEN

Rachel has been a tremendous help navigating the logistics necessary to start a small business. She has helped us identify and complete the steps to establish a legitimate organization. I am a creative who formed a nonprofit motion picture company. I understand story development, managing the production process, and fueling the creative spirit of aspiring production artists. I need support and guidance in accounting, networking, and establishing a sustainable entity. That’s where Rachel excels. I am so thankful to have Rachel as a partner to quickly get us started structuring the vital one, three, and five-year business plan to bring our dream to fruition. I recommend any entrepreneur who is serious about establishing professional independence partner with Rachel to make their dream a reality.

CHAD REYNOLDS

I have known Rachel for nearly two years. I am most impressed by her understanding of and ability to train on the specific issues that small businesses have with their accounting practices. Rachel has a genuine commitment to improving the bottom line of small businesses and it has been a great pleasure working with her. I highly recommend partnering with her!