When we live as onlookers, we spend the bulk of our time looking as onlookers in our lives. We can’t grow and prosper if we live life as spectators. It’s good to congratulate people on their accomplishments and achievements. Don’t let what others are doing, though, prevent you from living your own life. Participate in your own life story by taking an active part in it. What holds us back from living our best lives? 1. Fear Fear of change […]

When we worry about what others think about us and try and “keep up appearances”. We may find ourselves eager to please everyone but ourselves. Continuing with this way of thinking may eventually impact our businesses. Below are some tips on how to allow yourself to reach your full potential as a business owner and not put too much weight on other people’s opinions of you. Make an Effort to be Thankful To stop yourself from feeling like you have […]

Do you know what the most common complaint is among accounting professionals, whether they are CPAs, accountants, or bookkeepers? It’s not that accountants work long hours. It’s not that some of them despise dealing with the Internal Revenue Service. It’s not that they have to keep up with constantly changing accounting and tax laws. Accountants’ number one complaint is that small businesses put things off until the last minute – business owners PROCRASTINATE. We can all agree that business owners […]

We are instilled with the trait of responsibility at a young age. It teaches us to take responsibility for our actions rather than blaming others. It has more meaning as we grow older; it now means you are in charge of your life, particularly in terms of your financial situation. People who are financially successful understand that they are the only ones who can control their financial situation. Taking charge of your financial future does not necessarily imply taking charge […]

If you have children, one or more of these tax credits and deductions might be able to assist your family in reducing the amount of your tax liability for 2020. Consider the following examples; 1. Child Tax Credit The Child Tax Credit can generally be claimed for each qualified child under the age of 17. The maximum credit per child is $2,000.00. The Additional Child Tax Credit may be available to taxpayers who do not receive the full amount of […]

Maybe you’ve just started your company and aren’t sure if you need to hire an accountant. Perhaps you’re still in the planning stages of a new company and are debating whether or not you need someone committed solely to accounting before going all-in. You can be sure that if you ask an accountant if you should hire someone to support you with your books professionally, they would say ‘yes’. However, you can be assured that they are not saying “yes” […]

The United States Congress is expected to pass the third round of stimulus payments, meaning most Americans can expect another cash infusion in the coming weeks. Will you get a check? Individuals earning up to $75,000 per year, or couples earning up to $150,000 per year, are eligible for the full $1,400 per individual benefit. Head of Household filers who make $112,500 or less and have at least one dependent receive the maximum sum. The bill making […]

We may assume that successful business owners have no doubts, that they make snap decisions, never have regrets, and always know what to do. However, nothing could be further from the truth. Everyone, even the most confident leaders second-guess themselves. Self-doubt is a natural reaction to the obstacles that life throws at us. Even so, it doesn’t have to prevent you from facing challenges and achieving your objectives. Here are some helpful hints for overcoming uncertainty and channeling your energies […]

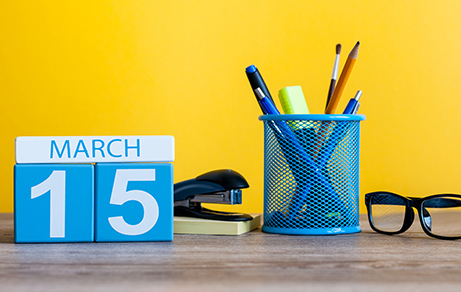

When it comes to income tax returns, April 15 isn’t the only deadline taxpayers need to think about. The federal income tax filing deadline for calendar-year partnerships, S corporations, and limited liability companies (LLCs) treated as partnerships or S corporations for tax purposes is March 15. Why the deadline change? One of the primary reasons for moving up the partnership filing deadline was to make it easier for owners to file their personal returns by the April filing deadline. After […]